3.3.3 Survival - Paddling In Someone Else’s Pool

In my previous article - “Survival! Focus on the things you control!” I suggested that you can divide your internal environment into two components - “doing the right thing” and “doing things right”. The former is the business strategy and the latter is operations. The article recommended that in the first instance, you should focus on operations - in particular the reduction of “transmission losses”.

Nevertheless, long-term survival will depend on doing the right thing - a thorough reassessment of your current business strategy, taking into account all the present and predicted changes in your external business environment. This review should be carried out under five headings.

- Activities - Now and in the future

Perhaps your company will add design to its list of activities. Perhaps you will cease manufacturing and rely on imports or contract manufacture by a third party.

- Markets - Now and in the future

Existing markets or new market segments or new geographical markets?

- Products - Now and in the future

Existing products or line extensions or new-to-the-company or even new-to-the-world products

- Competitive strategy

What is your competitive strategy now? Can you define it? Does it need reviewing?

- Competitive advantage

Do you know what makes your company different and better than its direct competitors? Is that attribute something that new customers will value as highly?

Those familiar with the bpi Wagon Wheel model of strategic planning will recognise the five components that make up the hub of the Wagon Wheel.

Uppermost in the mind of many manufacturers whose markets have been hit hard by the global financial crisis is the desire to diversify and enter new market segments using their existing manufacturing expertise and equipment. “Paddling in someone else’s pool” as a business acquaintance of mine puts it.

Often they are advised that they need to conduct a market study to determine such factors as size, growth rates, profiles of current suppliers, margins, barriers to entry etc. Such studies are time consuming and expensive and can only be justified if the market segment under consideration is large, complex and still growing rapidly.

It is so much easier to enter a growth market as the following example illustrates.

|

Total market |

Supplier 1 |

Supplier 2 |

Supplier 3 |

||||

Year |

Size |

% growth |

Units sold |

% market share |

Units sold |

% market share |

Units sold |

% market share |

Year 1 |

100 |

|

50 |

50% |

50 |

50% |

|

|

Year 2 |

200 |

100% |

100 |

50% |

100 |

50% |

|

|

Year 3 |

360 |

80% |

200 |

56% |

160 |

44% |

|

|

Year 4 |

576 |

60% |

250 |

43% |

180 |

32% |

146 |

25% |

Year 5 |

860 |

50% |

300 |

34% |

250 |

30% |

314 |

36% |

Here we have a rapidly growing market although as the figures in column 3 indicate the percentage growth is declining year by year from 100% in Year 2 to 50% in Year 5.

Even when Supplier 3 enters the market in Year 4, the sales of Suppliers 1 and 2 continue to increase even though Supplier 1’s percentage market share declines from a high of 56% to 34% in Year 5. Likewise Supplier 2’s percentage drops from 50% to 30%. In contrast Supplier 3 immediately grabs 25% market share and increases that to 36% in Year 5.

Supplier 3 is “permitted” to take 36% of the market because this pie is growing very rapidly and whilst the market shares of Supplier 1and 2 continues to decline, their sales continue to rise. Under this scenario a thorough market study might well be justified.

But how many market segments are you aware of where the total pie is continuing to grow vigorously?

And what happens when a new supplier attempts to enter a barely growing, static or declining market? Any sales that the newcomer makes will reduce the market share and the number of units sold by the existing suppliers. If Supplier 3 attempts to enter this market with a “me too” product, invariably the market entry tactic will be price. Customers will relay that new price to Suppliers 1 & 2 and ask them to meet it - which they will – they have no alternative. The invader is repulsed at the cost of lower margins.

The only way Supplier 3 can gain a share of the market supplied by Suppliers 1 and 2 is through innovation – most probably product innovation. Supplier 3’s offering needs to be perceived by customers as being both different and better.

Now you don’t have to conduct an expensive and thorough market survey to determine your product’s chances of success. For one thing, past growth rates, past supplier margins and profitability are largely irrelevant. In the current economic situation, you cannot extrapolate the present and future from the past.

What you can do is to take your different and better product to the key customers in this segment and determine whether there is a need for your innovation and what customers might anticipate paying for it. If it’s a substitute product, all the better. Diffusion will be quicker. Only then should time and other resources be spent on defining the market parameters. And really the only key number that you need to know is whether there are sufficient potential sales and margins to justify the investment required to put it on the market.

Reduce competition wherever possible

Here are two possible strategies:

- Use existing distribution channels

- Manufacture the product but market it through an existing supplier

The relative size of the market is important. If you need to sell 100 units pa for the product to be viable and the size of the total market is 500 units, your product will have to be very significantly better in the customers’ eyes. On the other hand, if the total market is 10,000 units, your sales target represents just 1% and the product does not have to be so highly differentiated.

Another key factor is the number of customers. It is far easier to enter a market with 1000 customers than it is one with 10. With a 1000 customers, the need for product differentiation is less as there is bound to be a sub-segment of the total market that is disenchanted with some aspects of their current supplier’s performance.

Lastly, there is the number of suppliers. A market with 50 suppliers is easier to enter than one with 5. There is a much greater chance of slipping in under your rivals’ radar.

There is no doubt in my mind that a truly differentiated product provides the best chance of diversification success. A recent example would be Apple’s iPhone.

If the potential to be different and better with the product is limited, the next place to look is the supply chain. How can IT be used to increase responsiveness to customer demand? Classic examples of success using this strategy are Benetton and Dell Computers.

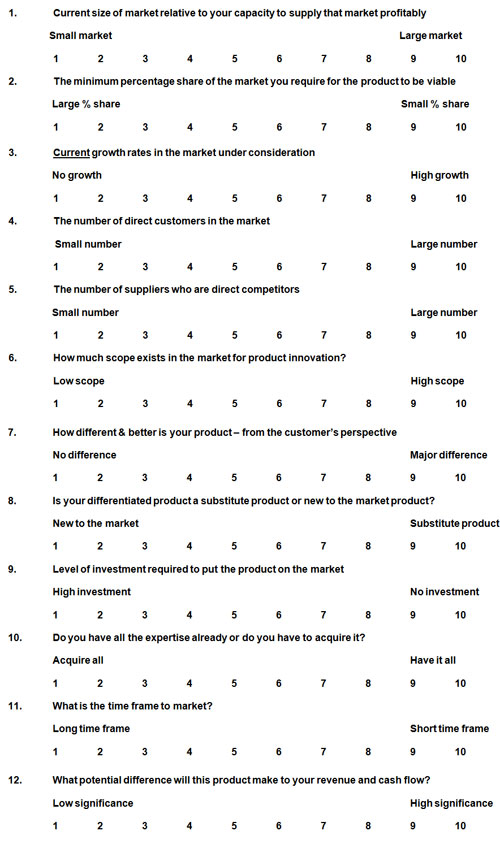

Quantifying the attractiveness of the market that you are considering entering

Factors 1 - 5 relate to the market; 6 - 12 to your product.

In all factors, the higher the rating the better. However, the lower the scores on factors 1 - 5 the greater the need for your product to be truly “different and better” and to score highly on factors 6 - 12.

One final point. Never forget that whilst you are contemplating paddling in someone else’s pool, someone else may have designs on yours. TLC towards your current customers has never been so important.