1.1.6 How To Develop A Stragetic Marketing Plan - HOW - Part 2

The previous articles have addressed the three stages of the planning process - NOW, WHERE and HOW (Competitive Strategy).

The last in this series also addresses HOW - but in the context of identifying a Competitive Advantage.

In the first of these articles - How to develop a strategic marketing plan - Stage one - it was explained that a Strategic Marketing Plan - or Commercial Plan - consists of five components.

- Activities - now and in the future

- Markets served - now and in the future

- Products/services provided - now and in the future

- Competitive Strategy

- Competitive Advantage

Whereas the Competitive Strategy is the game plan, the Competitive Advantage is superior execution. What is it that your company does that is different - and better than the competition. It’s a relative value as the following story illustrates.

Two men were going fishing for barramundi in the Northern Territory and one of them packed a pair of flippers in their aluminium “tinnie” along with the rest of the fishing gear. “I’ve heard there’s a big “salty” here that had a go at a boat the other day “ he said to his mate who laughed and replied - “you don’t think you can outswim a crocodile do you?”. “No - but I can outswim you”, was the reply.

Preceding “Competitive Advantage” with the word “Sustainable” has been resisted. With the exception of a Brand name and, possibly, physical location, no competitive advantage is sustainable forever and a day. Even patents have limitations as competitive advantages. To believe in a Sustainable Competitive Advantage results in complacency and frequently a rude awakening. Let’s face it - if it’s that much of a competitive advantage, your competitors will try their utmost to neutralise it.

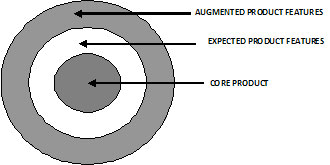

One tool that can be used to assist in the identification of a competitive advantage is an adaptation of the Total Product Concept.

Figure 1 - Core, Expected & Augmented Product

The Core, Expected and Augmented product attributes are defined as follows:

- Core product

Tthe fundamental product or service that you are providing is always the most important and critical component of the “product”. So for a restaurant, it is the food. For a Swatch watch, it is not just the timing mechanism itself but its value as a fashion accessory. For a saucepan, it is a combination of design, the materials from which it is made, its ability to conduct heat, its ease of cleaning etc. Because it is the most important aspect of the “product”, manufacturers expend huge resources in their attempts to differentiate their product from that of their closest competitors.

- Expected product

The attributes that your customer expects in addition to the core product. If the product were a car, for example, one would expect dealerships, service facilities, spare parts availability, warranties etc.

- Augmented product

The attributes that your customers value but which are not regarded as “must haves” but rather “nice to haves”.

Because Competitive Advantage is a relative concept, it follows that a supplier attribute that you excel in may not qualify as a Competitive Advantage because your competitors are equally proficient.

There is also a clear pecking order between Augmented, Expected and Core product attributes. Thus a Competitive Advantage in an aspect of the Expected Product will trump a similar advantage in an aspect of the Augmented Product. Likewise a Competitive Advantage in the Core Product will trump one in the Expected Product.

It’s clear from the above that identifying a Competitive Advantage requires good market research.

Take the following example. Customers were asked to rate the importance that they attached to the following attributes in suppliers of disposable safety clothing.

Attribute importance

Each respondent is asked to rate the importance that he or she attaches to each of these attributes on a scale of 1 - 10.

After each attribute is mentioned, a sentence of definition is read out to ensure consistency of interpretation.

The table below in the right hand column is the average rating for all respondents.

| Attribute | Average |

| Product quality | 9.4 |

| Product availability | 9.3 |

| Accurate paperwork | 9.1 |

| Problem handling | 9.0 |

| Pro-activeness | 9.0 |

| Flexibility | 8.9 |

| Order lead-time | 8.8 |

| Ease of order placement | 8.7 |

| Price | 8.5 |

| Product support | 7.9 |

| Product range | 7.3 |

| Representation | 6.1 |

| Average | 8.5 |

Product quality is rated the most important. It includes both design and quality of fit and finish. This is clearly the Core Product.

The attributes from Product Availability to Product Support are all aspects of the Expected Product. Their ratings indicate that they fall into the “must have” category.

Only the extent of the Product Range and the frequency of communication between the Suppliers’ representatives and the customers are in the category of the Augmented Product - “nice to have”.

It further emerged from the survey that there was approximate parity between suppliers on the Core and Expected products. Interestingly, no supplier rated highly on the quality of their Representation. Since it was known from previous surveys that, with a few exceptions, promoting oneself as a “one stop shop” is not rated highly by customers, only one conclusion could be drawn.

If this particular supplier (our client) could upgrade its representation and at the same time maintain its performance with respect to the Core and Expected Product, it could achieve a Competitive Advantage. So it increased the frequency of its Representation, appointed two new Account Managers and developed cooperative support programs. Not only did its own performance show a 20% rise in ratings but, more important was the competitive analysis that the following table reveals.

Competitive advantage

| Attribute | Better % | Same % | Worse % |

| Product quality | 24 | 72 | 3 |

| Product range | 31 | 34 | 34 |

| Customer service quality | 39 | 50 | 11 |

| Supply service quality | 41 | 41 | 17 |

| Product support | 48 | 45 | 7 |

| Representation quality | 62 | 28 | 10 |

Respondents were first asked to name the two closest competitors to our client. They were then asked if they were currently buying from these competitors. If the answer was in the affirmative they were asked whether, with this competitor in mind, our client was “better”, “same” or “worse” than the nominated competitor in regard to each of the attributes listed above. Each attribute is defined to ensure consistency of interpretation.

For a Competitive Advantage to qualify as such, the percentage of “better” votes has to exceed the sum of “same” and “worse” votes. In the above table, only Quality of Representation meets this criterion with 62% of “better” votes.

So Representation is both different and better. It is the Competitive Advantage.

Interestingly, the attribute that this company believes it excels at is Customer Service. Indeed, its performance on those factors that deliver customer service was higher than the rating for Representation. However, their competitors also provide customer service of a high order – witness the “same” vote at 50%. So Customer Service does not meet the criteria for a Competitive Advantage.

The Total Product Concept is a dynamic one. Those customers that had benefited the most from the new standards of Representation would begin to view this attribute as a “must have” rather than a “nice to have”.

The Strategic Marketing Plan is now complete. The company has decided where it wants to go in terms of markets, products and activities and how it is going to get there in terms of a Competitive Strategy and Competitive Advantage.

In truth, though, this is only the end of the beginning. The impact of the plan has still to be gauged on all the Support Functions. Furthermore, does the company have the people, the structure and the finances to implement the plan?

The reality is that planning is often the easy part; it’s the implementation that’s hard.

For a holistic and integrated approach to Strategic Business Planning, read the related article - Strategic Planning that Works